Financial Modeling in Excel

Financial modeling in Excel helps professionals analyze business performance, forecast future outcomes, and support decision-making. Using formulas, scenarios, and structured assumptions, Excel models transform raw financial data into actionable insights for budgeting, valuation, and strategic planning.

Outline

Module 1: Introduction to Financial Modelling

• What is financial modelling?

• Types of financial models

• Uses in business & decision making

• Model structure & best practices

Module 2: Excel Setup for Financial Models

• Excel layout standards (Inputs, Calculations, Outputs)

• Color coding conventions (Inputs / Formulas / Outputs)

• Model documentation techniques

• Naming ranges & structured references

• Keyboard shortcuts for model building

Module 3: Core Excel Skills for Financial Modelling

• Essential formulas (SUMIF, COUNTIF ,IF, IFS, VLOOKUP, XLOOKUP)

• Logical & nested calculations

• Error handling (IFERROR)

• Date & time functions for finance

• Absolute vs relative references (Best practices)

Module 4: Financial Statements Fundamentals

• Income Statement structure

• Balance Sheet structure

• Cash Flow Statement structure

• Linking the three financial statements

• Understanding financial flows

Module 5: Building a 3-Statement Financial Model

• Revenue assumptions

• Cost & expense drivers

• Depreciation

• Working capital assumptions

• Debt & interest calculations

Module 6: Time-Based Financial Modelling

• Monthly, quarterly & yearly models

• Fiscal year handling

• Dynamic timelines

• Period-based calculations

Module 7: Assumptions & Drivers Based Modelling

• Key business drivers

• Scenario-based assumptions

• Growth rates & margins

• Sensitivity to inputs

• Best practices for assumptions sheets

Module 8: Cash Flow & Working Capital Modelling

• Operating cash flow

• CapEx modelling

• Inventory, receivables & payables

• Free Cash Flow (FCF)

Module 9: Financial Ratios & Performance Metrics

• Profitability ratios

• Liquidity ratios

• Leverage ratios

• Efficiency ratios

• KPI dashboards in Excel

Module 10: Financial Model Presentation & Visualization

• Model outputs & dashboards

• Charts for financial data

• Executive-level summaries

• Formatting & presentation best practices

Course Fee

● Online

Rs. 12,000/- Total

- Once paid, the fee is non-refundable and non-transferable

Account Details

Bank: Habib Bank Limited

Account Title: AIN GenX

Account No: 5910-70000512-03

IBAN No: PK08 HABB 0059 1070 0005 1203

Facilitators

Irfan Bakaly

Data Analyst

25+ years of experience in Data Analysis

Noor Surani

Tech Entrepreneur

25+ years of experience in Data Analysis

Who this course is for:

Finance professionals, Accountants and auditors, Financial analysts and investment professionals, Managers involved in budgeting, forecasting, and reporting, Students or graduates

Duration

● 6 Weeks (15 Hours)

Classes

● Online via Zoom

Schedule

- Day: Saturday's Only

- Timing: 11:00 - 01:30 pm (PST)

Starting From

● Saturday, 14 February, 2026

Participants from Top Organizations

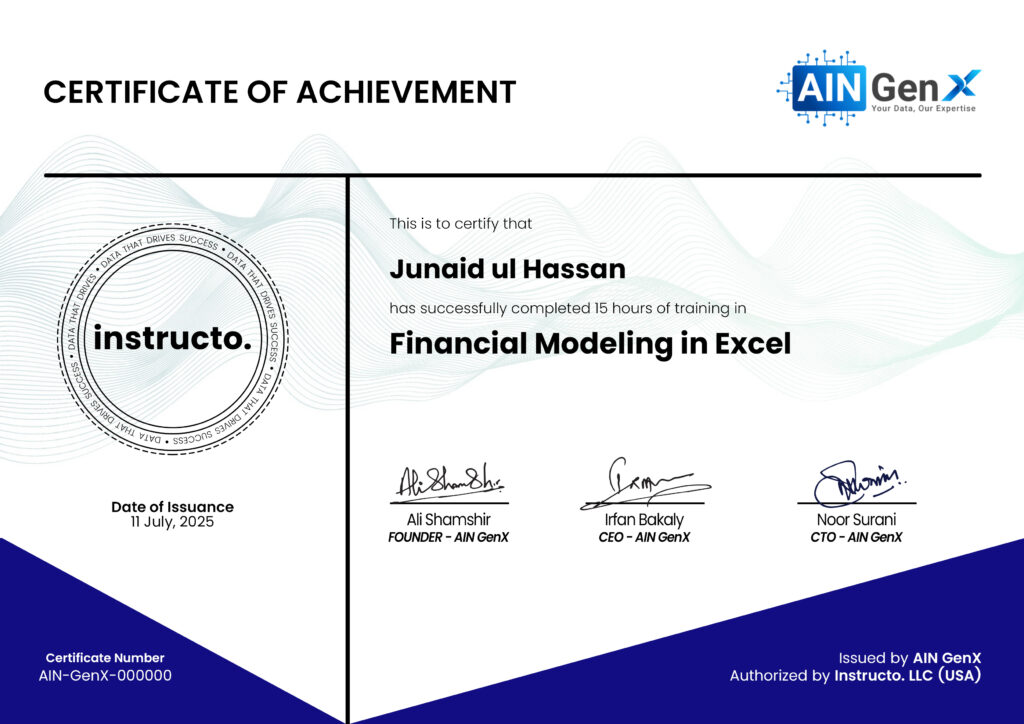

Certificates